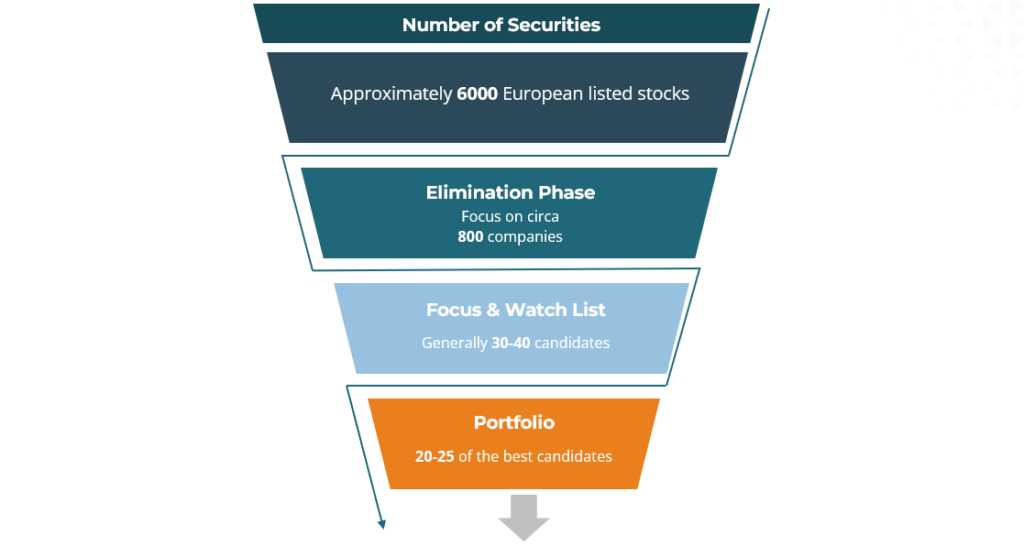

Day 10 of European Focus uncovers the Fund’s screening process of companies

On day 10 we are lifting the veil off the Fund’s screening process of companies.

Adding new companies to the Universe:

When we add new companies to the investment universe, we use a two-tiered approach.

- Quantitative screen: where we download sales and EBIT numbers for the past 10 years and rank them from the highest to the lowest growers. By using such a long-time frame, we aim to eliminate the problem with cyclical swings. We then eliminate non-grata industries (non-ESG compliant businesses, energy, mining, banks, insurers etc.).

- Qualitative assessment: we look at growth and sustainability themes. We seek industries with bigger end-market (by value and volume); increased affluence; shifting business models; ‘pockets of demand’ (B2G government – B2B corporations – B2C households). The idea with pockets of demand is that businesses generally thrive when they are selling to affluent buyers. (I am not a trained lawyer, but I presume if you want to make money, you go into corporate law since companies are generally good payers. This compares with criminal law where customers tend to be less well off.)

Once we have selected 1-3 new prospects, we first do a full due diligence on the company. This encompass understanding the industry, the company’s position in the industry vs. the competition; financial modelling. We build all our models inhouse and from scratch – that way we can ensure that we understand any restatements. This is also a great way to get a better understanding of the moving parts of the company as to which the key drivers are to sales and profits. We look at who the key shareholders are and ESG relevant KPIs. We also go out and meet management at the company’s premises. What we want answer to is this: ‘Do we trust them and do we want to be in business with these people?’

Secondly, we do a due diligence on the stock. We check when the stock performed well and badly – both in absolute terms as well as relative to the market. In a similar way, we analyse the other stocks in the sector to see if there are similarities.

We spend a lot of time on the stock’s valuation. We generally use eight valuation methods to get a balanced and ‘intrinsic’ valuation on the stock. The spirit of what we try to achieve is to calculate something to be ‘approximately right’ rather than ‘exactly wrong’.

Equally important, we analyse how the stock was valued from one market-cycle to the next. To the degree that we have adequate data, we tend to start in 1990 in order to get a 30-year valuation range of the stock. This way we can easily ascertain if the stock has re-rated over time (both in bull and bear-market environments) or just reached its past peak-trough valuations.

For further information please visit the Fund page here.

This is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. This is not intended to be construed as investment research. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook Street, Mayfair, London W1K 4HS

tel +44 20 7070 1800

email [email protected]

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.