Heptagon European Focus Equity Fund Mantra

The Magic of Compounding! Divulging into European Focus Fund’s mantra on day 5!

Once a good business in a good industry has been identified – stick with it: European Focus aims to live by the mantra Warren Buffett once expressed: ‘Time is the friend of the wonderful business and the enemy of the mediocre.’ In equity market terms this implies that time will normally reward the owner of a strong business. However, due to the frequent premium valuations of such a business, unfortunate timing of an investment in such a business can be an occupational hazard. Christian often goes into great length into what constitutes a good business as well as a good industry, but in simple terms they share two commonalities: their end-markets grow by volume and value over time.

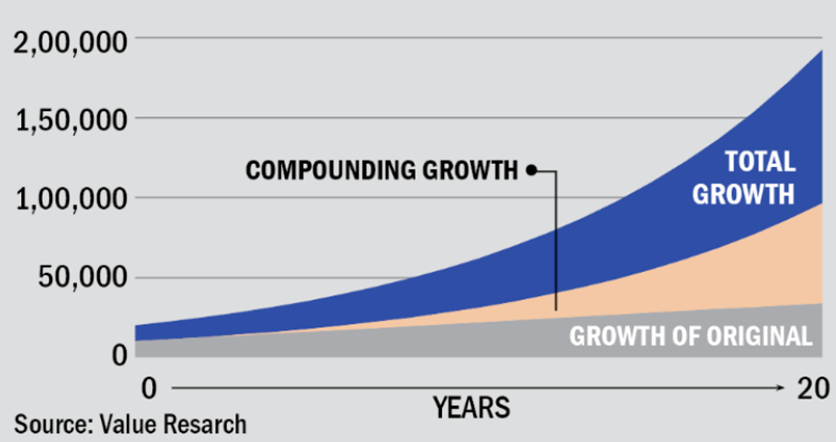

Once invested in a good business, compounding is amazing: compound returns make an investment grow faster because the interest is calculated on the accumulated return over time as well as on the principal. If compounding is successful, it can create a snowball effect, as the original investments plus the income earned from the investments, grow together. Albert Einstein is supposed to have said: ‘Compound interest is the eighth wonder of the world – he who understands it earns it; he who does not pays it.’

Follow along for tomorrow’s sweet stock profile!

This is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. This is not intended to be construed as investment research. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook Street, Mayfair, London W1K 4HS

tel +44 20 7070 1800

email [email protected]

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.