Post #91: is bitcoin finally coming out of age

Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation.

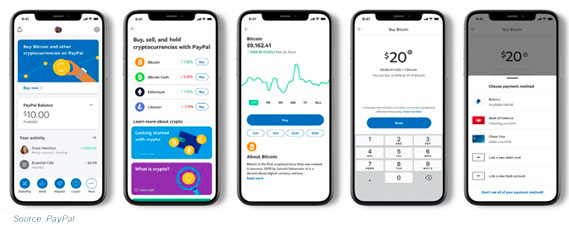

Blink and you may have missed it. Bitcoin has been one of the best performing assets in the world year-to-date, up over 80%. Even prior to the announcement last week from PayPal that it would enable cryptocurrencies as a funding source for digital commerce with its 26m merchants, the price of bitcoin had more than doubled from its pre-pandemic level. So, what’s going on?

We have argued for some time that the world is going more digital. Correspondingly, the use of cash is declining – and this trend has only accelerated in recent months. It was perhaps inevitable then that there should be a greater role for cryptocurrencies such as bitcoin. The PayPal announcement was arguably a watershed moment. Consider that PayPal has close to 500m users on its platform. By comparison, there are fewer than 25m identifiable holders of bitcoin presently and only 100m unique-identity verified users surveyed across all crypto exchanges (per Protocol). In other words, PayPal has almost five times more users than bitcoin. Their vote of confidence in crypto should therefore be considered as significant, taking alternative digital currencies from simply being an investment asset into something which could – albeit over time – replace Dollars.

Lest we get too excited, it’s worth reading the small print. Sure, beginning in 2021 PayPal’s US customers will be able to use their cryptocurrency holdings as a funding source to pay at PayPal’s 26m+ merchants. However, users won’t be able to take their cryptocurrencies out of their PayPal accounts once they’ve acquired it, meaning the money effectively lives in the app until it is either sold or used. Further, it can’t be sent to other people. Most notably, merchants on its platform won’t actually receive their payments in crypto – even if they are made this way; they will be converted back to Dollars, and at a notable fee (3% on transactions of less than $100, with a minimum charge of $0.50 for transactions below $25).

It’s still, of course, very early days. Even if 1 in 10 Central Banks say that they expect to issue their own digital currencies within the next three years (per the Bank of International Settlements), many more significant hurdles than those outlined above need to be overcome (and these may be revised over time). Importantly, crypto payments will need to be linked successfully into a broader transaction network (processors such as Mastercard and Visa potentially have a role to play here), while security, compliance and regulatory protocols need to be standardised.

Nonetheless, we should still regard the move of PayPal as significant. The reason why is that all currencies – but particularly novel ones such as cryptos – are about trust. Crucially, PayPal has built a very high level of trust with its customer base, having helped many people to have done their first web and/or mobile-based transactions over the last decade and more. When its service is rolled out to international markets (in the first half of 2021 according to PayPal), your author is likely to be among the early adopters – in the name of research if nothing else.

29 October 2020

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. Heptagon Capital is an investor in PayPal. The author of this piece has no personal direct investment in the business. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook Street, Mayfair, London W1K 4HS

tel +44 20 7070 1800

email [email protected]

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.