Key Themes for 2021 and Beyond

Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation.

Executive Summary: Thematic investing is a core part of our investment process at Heptagon. Since 2011, we have published 50 dedicated pieces of thematic work, and this constitutes our ninth annual review of the key long-term secular trends that we expect to grow in importance over time. The themes we have investigated – many of which are discussed in more detail later in this commentary – not only have the power to capture the imagination, stimulate and cause debate, but also constitute an integral element of our investment process. Investors can access a range of leading businesses exposed to these trends via the Heptagon Future Trends Equity Fund, which will celebrate its fifth anniversary as UCITS Fund in January 2021.

2020 has been a quite remarkable year, unlike anything we have witnessed previously. Beyond the clear and tragic human cost, it has forced us all to reassess how we both live and work. Many future trends we have discussed in the past have obviously accelerated or been turbo-charged by the pandemic. There may now be no turning back. If we have not already, then we are certainly becoming digital by default. We have been discussing this dynamic in detail since the early part of this year, when we first published our Digital Rubicon thesis.

Adaptability is crucial. As Charles Darwin the de facto mentor of the Future Trends strategy famously describes, the species that survive will be those “most responsive to change.” Think about it like this. 2020 can be divided into two parts: life before COVID-19 and life with COVID-19. What comes next is unclear and not the subject of debate here. In the first three months of the year – prior to enforced lockdown – your author took over 20 flights and travelled to 8 different countries across 3 continents in order to understand the future better and share his conclusions with potential investors. Since then, he has not been to an airport either for business or pleasure but has met virtually with companies and clients across the world.

In addition to having published notes on five themes (solar energy, 5G, hydrogen, EdTech and data revisited), in 2020 we have conducted over 50 virtual meetings with management teams at businesses across the world. Furthermore, we were lucky enough to spend a week in the US in March meeting many corporates at their headquarters while it was still possible to do so. Conferences too have had to move online, and we participated virtually in events as diverse as the Norwegian Hydrogen Conference and Big Data LDN. Sadly, many other events we had hoped to attend, such as the Future Fest and Medtech Innovation, were cancelled, but we made up for this by speaking with a host of industry experts. Much of our activity is captured in the Future Trends Blog. All our Blog posts can be found on the Heptagon website and are accessible via LinkedIn and Twitter too.

All the themes we uncover share two common factors: their exponential growth potential and an inherent element of disruption. There is a challenge laid in the face of existing business models by often doing things better and more efficiently. We present below a summary of how and where we see the world changing most rapidly. Please note, this review is non-exhaustive; think of it rather as a series of interlinked high-level perspectives. We continue to believe that as diverse future trends overlap and intersect, they become mutually reinforcing. Few areas of the world will remain untouched. Please read on.

Alternative Energy

First discussed: Winds of change” (March 2018); Everybody loves the sunshine” (January 2020)

2020 Blog Posts: #56, “Let the wind blow” (10 February); #67, “Happy Earth Day” (29 April); #72, “Virtual postcard from Oslo” (4 June); #73, “Going green in the UK” (10 June); #81, “Work here, if you want to innovate” (6 August); #89, “Making America great again” (13 October)

“The eyes of all future generations are upon you”

Greta Thunberg, Climate Change Activist

Think back to the early days of lockdown: UK road travel volumes reached a level last seen in 1955, international flights originating from the US were down 72% year-on-year and Chinese industrial production was 13% lower than a year prior (per Reuters). Globally, rivers, oceans, wildlife and the atmosphere breathed a metaphorical sigh of relief as polluting activity was put on hold. 2020 will likely be remembered as a year where many more traditional ways of thinking and doing business were re-assessed. With falling costs, the disconnect between economic and environmental objectives is rapidly closing. Consider that 23 countries have already defined dates when they anticipate becoming net zero carbon producers (per the United Nations). The EU has stated that 32% of the Continent’s electricity should be derived from renewables by 2030, while Germany is targeting a complete coal phase-out by 2038. California recently mandated that all new builds need to be powered at least partially using solar and is targeting a 2045 date to be 100% carbon- free. Even China recently announced its intention to become carbon-neutral by 2060.

Solar and wind are now the cheapest energy option for two-thirds of the world

source: Bloomberg New Energy Finance

The direction of travel towards such commitments is already yielding benefits. BP estimates that for the first time ever, global energy demand is levelling off in the face of stronger climate action, with oil demand set to fall at least 10% this decade and by 50% over the next 20 years. Despite a near-record drop in power consumption in the first half of this year – remember the statistics above – wind and solar produced a record

10% of global electricity (per Ember, an energy think-tank). Impressively, power drawn from wind and solar has more than doubled since 2015, with these sources winning market share, primarily at the expense of coal. Renewables year-to-date have generated more energy than coal in the US, with coal shipments from the US at their lowest levels since 1983 (per the International Energy Agency, or IEA).

We should only expect further progress given that the fall in the levelized cost of energy for renewables (i.e. on a like-for-like basis with other comparable sources) means that solar is now competitive with coal and gas on a utility-scale basis. Wind has been for some time. Solar costs have now fallen fivefold since 2010. Correspondingly, solar and wind are indeed now the cheapest energy option for two-thirds of the world (all data per Bloomberg New Energy Finance, BNEF). Global installed renewable energy generation has therefore risen three-fold in the last decade but is forecast to more than double again over the coming 30 years (from ~3000GW to over 8000GW, per the IEA).

Thought of another way, the amount spent on renewable energy is set to exceed the amount spent on oil and gas drilling globally for the first time in 2021 (per Goldman Sachs). “Different conversations” about the case for wind are now being had post the emergence of the COVID-19 virus, per Henrik Anderssen, the Chief Executive of Vestas. When asked about the outlook, he described the glass as “being more than half full.” If $120tr of cumulative investment is required by 2030 to hit all countries’ currently stated renewable targets (as estimated by BNEF), then there will emerge clear opportunities not just within the wind and solar space, but also increasingly in the energy storage market as well as with regard to more emerging alternative energy technologies such as hydrogen.

The Car of the Future

First discussed: “The long road to autopia” (April 2015)

2020 Blog Posts: #66, “The future is still happening, right?…” (21 April)

“We will not stop until every car on the road is electric”

Elon Musk, Chief Executive of Tesla

How we travel both for business and pleasure is closely bound up with the theme of alternative energy. The broad climate solutions market including renewables, electric vehicles (EVs), batteries, biofuels, circular economy plays and moonshots could double in size to more than $2tr by 2025, per Bank of America Merrill Lynch. From the perspective of the car, it seems clear to us that vehicles are going electric, even if they are not quite yet becoming autonomous. Many governments globally have made commitments as part of their carbon-neutral strategies to phase out all sales of new gas powered vehicles over the next 20 years.

Over 50% of consumers don’t believe autonomous vehicles to be safe

source: Deloitte

Total global EV sales reached 7.5m units at the end of 2019, up from just 17,000 in 2010. Despite this 441- fold increase, EVs still account for less than 2% of total global automobile sales (per 13D Research). Expect this to change markedly in the coming years. Automakers globally have committed at least $225bn to EVs over the next five years (and Volkswagen $44bn alone) with the intention to abandon the development of all new fossil fuel vehicles by 2026. The German car manufacturer believes that by 2040, all new vehicles will either by electric, plug-in hybrid or hydrogen fuel cell electric, in an approximate 70:20:10 ratio (per Bloomberg). BNEF forecasts that EVs will represent 58% of all new passanger car sales by 2040, equivalent to 58m units.

Electric vehicles are certainly getting better, with some permitting for up to 400 miles on a single charge. However, for EVs to become more ubiquitous, more charging infrastructure will also need to be built. Over 1m public electric vehicle charging points have been installed globally. Germany has now made it mandatory for all petrol stations to include electric chargers and the EU has in place a target of 1m chargers across the continent by 2025. For context though, if all UK cars are to become electric by 2035 – per the government’s target – then over 500 chargers would need to be installed each week for the next 15 years (per Bloomberg and the Society of Motor Manufacturers respectively). More investment in this area seems likely. By contrast, progress on self-driving vehicles has been stubbornly slow and may take somewhat longer to play out. Elon Musk’s vision of 1m robo-taxis on the road by the end of 2020 (first enunciated in April 2019) will clearly not come to pass. As an end-2021 objective, it also appears somewhat optimistic for now.

Healthcare Solutions

First discussed: “Reinventing healthcare” (November 2012); “Healthcare transformed” (April 2013)

2020 Blog Posts: #75, “Mr Venn explains healthcare” (22 June); #79, “Commercialisation amidst the dreaming spires” (21 July)

“We can survive the future only if we innovate and provide (market) access to our innovation… we are just at the beginning of the innovation curve”

Lars Jorgenson, Chief Executive of Novo Nordisk

With the COVID-19 pandemic still far from under control, healthcare solutions – or just understanding the body better – is top of mind for many. Consider that (our) biology is immensely complex: the human genome has 3m DNA bases; each cell then has its own epigenetic base, and the human body has 40tr cells. The human genome was first sequenced in 2003 and, at the time, the cost of doing so was $2.7bn. (per 10x Genomics and www.genome.gov respectively).

Fewer that 0.01% of all species have had their DNA sequenced

source: Illumina

Now, it is possible to sequence a genome for little more than $600, with costs set to drop below $200 soon (per Illumina). This exponential decline in genome sequencing costs has allowed companies to decode the DNA of the SARS-CoV-2 coronavirus genome and progress it to human testing within 45 days, a process that took almost two years with secure acute respiratory syndrome (or SARS – data per Goldman Sachs).

Beyond near-term solutions to the COVID-19 pandemic, the broader opportunity remains significant. Fewer than 0.01% of all species and 0.02% of all human genomes have been sequenced, while less than 1% of all variants in the human genome are fully characterised (per Illumina). Thought of another way, while estimates suggest that there are ~13,000 identified human diseases, only ~500 of these are currently considered curable, and many still lack diagnostic tests. Within this figure, ~7,000 are so-called ‘rare’ diseases, with fewer than 200 annual cases (per the World Health Organisation). A combination of sequencing and precision medicine could revolutionise our ability to treat many of these.

Food Innovation

First discussed: “You are what you eat” (October 2014)

2020 Blog Posts: #52, “Pork without pig? Impossible!” (14 January); #57, “How big is your finprint?” (19 February); #61, “Chips and fish” (17 March); #84, “Shout it from the rooftops” (10 September)

“Unlike the cow, we can get better at making meat every single day”

Pat Brown, Chief Executive of Impossible Foods

Being healthy is partly a function of living better. This dynamic will matter increasingly as the world’s population ages. Bear in mind that 80% of people over the age of 65 have one chronic disease, while 50% have two or more chronic conditions. More than half of all American adults may be obese by 2030, while the total addressable market for diabetes – not including those with unmet needs – is already worth more than $48bn (per the UN, the New England Journal of Medicine and Novo Nordisk respectively).

Forecast population growth means current global food supply levels will need to increase by 70% before the end of the century

source: World Health Organisation

However, the good news is that the human health market is growing at annual rate of over 5% (per Christian Hansen). While there are some evident secular drivers at work – not just an ageing population, but also resource scarcity and technology breakthroughs – the pandemic has, if anything, raised health awareness as well as heightening the desire for a more sustainable future. As one industry executive recently put it in conversation with us, “people want to know what they are putting in their bodies.”

Per-capita meat global consumption is set to fall in 2020 to its lowest level in nine years. The decline has been partly inspired by the pandemic (reduced income as well as health concerns), but even meat consumption in the US may not return to pre-crisis levels until at least 2025 (per the United Nations). If more people were to commit to a plant-based lifestyle, this could reduce not only global mortality, but also lower carbon emissions while simultaneously boosting economic output. Plant-based proteins shipped to commercial restaurants have risen more than 20% versus a year prior, while almost 25% of all new food product launches in the UK are now labelled as vegan (per UBS and Mintel respectively). Globally over three times more patents are being granted in ‘food chemistry’ (i.e. ingredients, plant-based proteins, cultured meats and personalised nutrition) than was the case in 2018. Against this background, the ‘value-added food market’ could be worth over $300bn globally by 2025 (per Bank of America Merrill Lynch).

The Power of Data

First discussed: “The data deluge” (March 2011)

2020 Blog Posts: #62, “Virus vs the Internet” (23 March); #65, “Every cloud has a silver lining” (14 April); #69, “Appy days” (13 May); #74, “Learning in London; not meandering in Munich” (18 June); #76, “Keep your data close; maintain your social distance” (29 June); #77, “Your one-in-four chance” (7 July); #80, “AI = Abundant Inspiration” (29 July); #86, “All about data” (25 September)

“Every company would need to become an AI company- not because they can, but because they must”

Arvind Krishna. Chief Executive of IBM

All industries generate data. What they do with it, however, is crucial. Our broad contention has always been that data have no value unless they are effectively stored, secured and analysed. We explore this theme in more detail in our most recent theme piece, “Ten years on: data deluge 2.0”. However, consider at a high level that 90% of all data created in 2018 did not even exist two years prior. If we were to take the 33ZB of data generated that year, it would be enough to fill over 7tr DVDs (per IDC).

Over 7tr DVDs would be needed to hold the total amount of data generated by the world in 2018; the not-yet-released figure for 2020 will likely be markedly higher

source: IDC

At least 60% of all data generated goes unanalysed (per Forrester Research), underscoring the need for artificial intelligence. Consider the four industries we have highlighted thus far. Algorithms now exist that inform at what levels turbines should operate depending on the direction and force of the wind. This has resulted in multiple cost savings and efficiency gains. Turning to cars, consider that vehicles are increasingly becoming computers on wheels. Traditional mechanics are being replaced by electrics; hardware by software. Greater vehicle autonomy will require more advanced data analytics. With regard to healthcare, Illumina’s systems generated over 100PB of data in 2018, equivalent to more than 25 times the size of Netflix’s back catalogue. If the generation is the easy bit, the analysis is markedly more complex. Elsewhere, Deloitte calculates that AI could accelerate drug discovery and pre-clinical testing by a factor of 15. This matters, particularly since more than 90% of new drugs currently fail clinical trials. Finally, within the realm of food, note that only 2 in 10 customers say they have complete confidence that their food is safe to eat. Unsurpsingly then, over 70% state that they would be willing to pay (albeit a premium) for the traceability of their products (per Zebra Technologies and IBM respectively). Doing so is another data (analytics) exercise.

Worldwide AI spending will reach ~$50bn this year but could grow to $110bn by 2024 (per IDC). Storing this data – most likely in a hybrid model comprising multiple clouds (both public and private) as well on-premise and at the edge – will be crucial. As we highlight in our data theme piece, the cloud opportunity remains significant, given that less than 10% of global annual IT spend has thus far migrated to the cloud (per AWS). Finally, do not forget the importance of securing data. $8tr will be spent globally fighting cybercrime by 2022, while some 54% of organisations state that they are not confident in handling anything more than basic cyberattacks (per Juniper Research and Mimecast respectively). The data deluge continues.

Cashless Society

First discussed: “Cash dethroned” (May 2013)

2020 Blog Posts: #55, “Dash for cash(less)” (5 February); #60, “The view from the Research Hub” (11 March); #91, “Is bitcoin finally coming of age?” (29 October)

“We want to digitise every form of payment”

Ajay Banga, Chief Executive of MasterCard

We produce and consume data daily. Writing this document generated data. Every time we use a computer or a mobile device, consider it a data exercise. Practically, whether it be energy, food, healthcare – anything really – it costs money. Payments are perhaps, therefore, one of the most visible forms of data; and, the industry is only heading more digital.

Over 70% of all global payments by volume are still transacted via cash

source: Visa

Digital payment volumes hit $1.4tr globally in 2019 but vary markedly across the world. In Singapore, the average inhabitant made 831 cashless transactions annually. In South Korea and Sweden, the figures also top 500, with no other country coming close (per the Bank of International Settlements and JP Morgan). Cash and cheque payments account for more than 70% of personal consumption expenditure in Central Europe, the Middle East and Africa. Even in the US and Europe, the figures are 33% and 32% respectively. The average American still makes 12 cash transactions monthly (per Visa). Note all the above statistics were made pre-COVID.

However, we are now at a tipping point. As with every other industry discussed in this piece, the behaviours inspired by the pandemic are largely responsible. It’s not just what happened at the beginning – consider, for example, that cash machine volumes in the UK fell 62% year-on-year in the first week lockdown (per the BBC) – but how changed behaviours have become entrenched. A Mastercard survey in July 2020 found that 79% of consumers interviewed worldwide are now using contactless, and 74% say they will continue to do so post-pandemic, primarily because it is both safer and quicker.

Viewed from the perspective of businesses, 76% interviewed by Mastercard stated that the pandemic has prompted them to become more digital, with 82% changing how they send and receive payments. Over 60% of businesses say they are now actively steering both their customers and suppliers away from cash and cheque. As PayPal’s Chief Executive, Dan Schulman notes, “I don’t think there is any going back from this.”

Online Retail

First discussed: “Cash dethroned” (May 2013)

2020 Blog Posts: #55, “Dash for cash(less)” (5 February); #60, “The view from the Research Hub” (11 March); #91, “Is bitcoin finally coming of age?” (29 October)

“The pandemic has accelerated the retail revolution, pulling forward several years of adoption”

Dan Schulman, Chief Executive of PayPal

Where better to see the digital (or cashless) by default dynamic at work than in the world of retail? Consider that every minute, consumers spend $1m online and Amazon ships 6,000 packages. Viewed another way, every second, some $11,000 worth of goods change hands on Amazon’s e-commerce platform. Last year, the business delivered 3.5bn packages – equivalent to one for every two humans on earth (per Visual Capitalist).

Every minute of the day, over $1m is spent online

source: Visual Capitalist

While the above statistics are quite remarkable, and while Amazon may account for 39% of total US online sales, Amazon’s retail revenues comprises just 4.6% of total US commerce (per Bloomberg, using 2019 data). PayPal estimates that around 85% of total retail expenditure remains in a physical format. This is despite the fact that at least 70% of consumers currently have some concerns about shopping physically (at least according to PayPal).

E-commerce penetration levels vary widely across the world, from over 25% in China and around 20% in both the UK and South Korea, to closer on 15% in the US; less than 10% across most of continental Europe and less than 5% in much of the emerging world (per McKinsey, as of end 2019). Regardless, the pandemic brought about a marked shift in almost every geography.

The same McKinsey study suggests that in the 90 days from lockdown commencing, consumer and business digital adoption was vaulted forward by between 5 and 10 years, depending on the country. In the three months ending July, e-commerce penetration rose by 5 percentage points in the US and by more than 10 points in the UK (per the US Census Bureau and ONS respectively). Ocado, a UK online-only grocery retailer, currently has a waiting list of over 1m customers. Globally, online retail sales may hit $3.9tr in 2020, a 17% year-on-year increase, with 35-45% of this increase turning out to be permanent (per Emarketer and Bain respectively). Long live online retail.

Automation and Robotics

First discussed: “The robot revolution” (July 2012)

2020 Blog Posts: #63, “Why is there no toilet paper in the supermarket?” (31 March); #68, “Rise of the robots” (7 May); #88, “Ready for the holiday season?” (7 October)

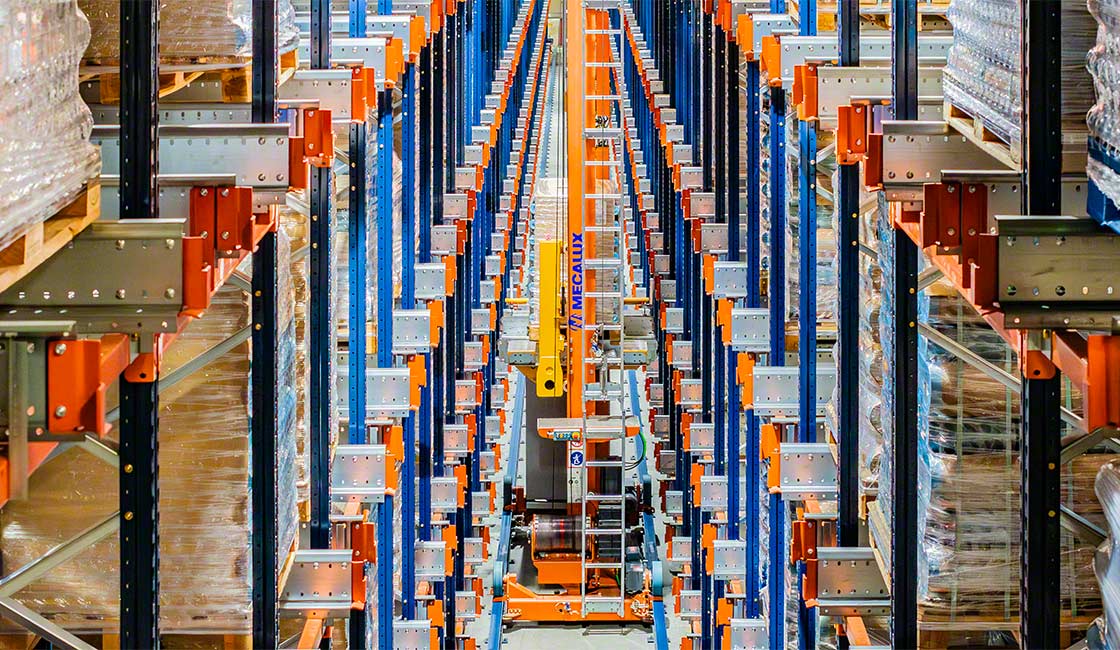

“The line between disorder and order lies in logistics”

Sun Tzu, Ancient Chinese Philosopher

The simple reality is that e-commerce requires three times more logistics spaces than brick-and-mortar sales. Online order fulfilment requires more logistics since 100% of inventory is stored within a warehouse (versus on store shelves), which allows for greater product variety, deeper inventory levels, space-intensive parcel operations, and additional value-add such as returns processing. Every extra $1bn spent online requires another 1.2m square feet of logistics space (per Prologis). Consider that Amazon plans to end 2020 with 209 US fulfilment centres in the US. This compares to 173 a year prior and just 26 a decade ago.

By 2025, there may be 1 robot for every 3 people globally

source: Boston Consulting Group

Against this background, it should come as no surprise that the global e-commerce automation market is growing at a 14% CAGR. 49% of warehouse and distribution centre managers say they still use mostly manual processes in order fulfilment, yet almost all expect to be using some form of AI, advanced analytics and IOT-based supply management by 2023 (per Gartner). Crucially, 30% of operational workers will not be replaced by (collaborative) robots, per Gartner’s study. Rather, robots will complement the work performed by humans.

Most robots today are deployed in assembly lines to build cars or to put chips on circuit boards. Together, these industries account for ~60% of global demand (per Deloitte). Already, the global robotics market is worth $50bn (per the International Federation of Robotics, or IFR), but the runway ahead is significant. Existing robotic penetration varies markedly by geography (from 855 robots per 10,000 employees in Singapore to less than 200 in the US). Meanwhile, many industries (such as warehouse logistics) are just beginning their deployment of robots. Against this background, some consultants (e.g. BCG) believe that by 2025, there may be 1 robot for every 3 people globally.

Change is coming to all industries. To rephrase Charles Darwin, those businesses that survive will be the ones that manage this change most responsively.

Alex Gunz, Fund Manager, Heptagon Capital November 2020

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook Street, Mayfair, London W1K 4HS

tel +44 20 7070 1800

email [email protected]

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.