Post #11: What happens in an Internet minute…

Have you searched on Google, WhatsApp’d your friend or perhaps swiped on Tinder in the last minute? If so, you are one of millions. But just how many millions? One of the charts we anticipate most eagerly every year was released last week on the Visual Capitalist website, highlighting exactly just what happens in an Internet minute.

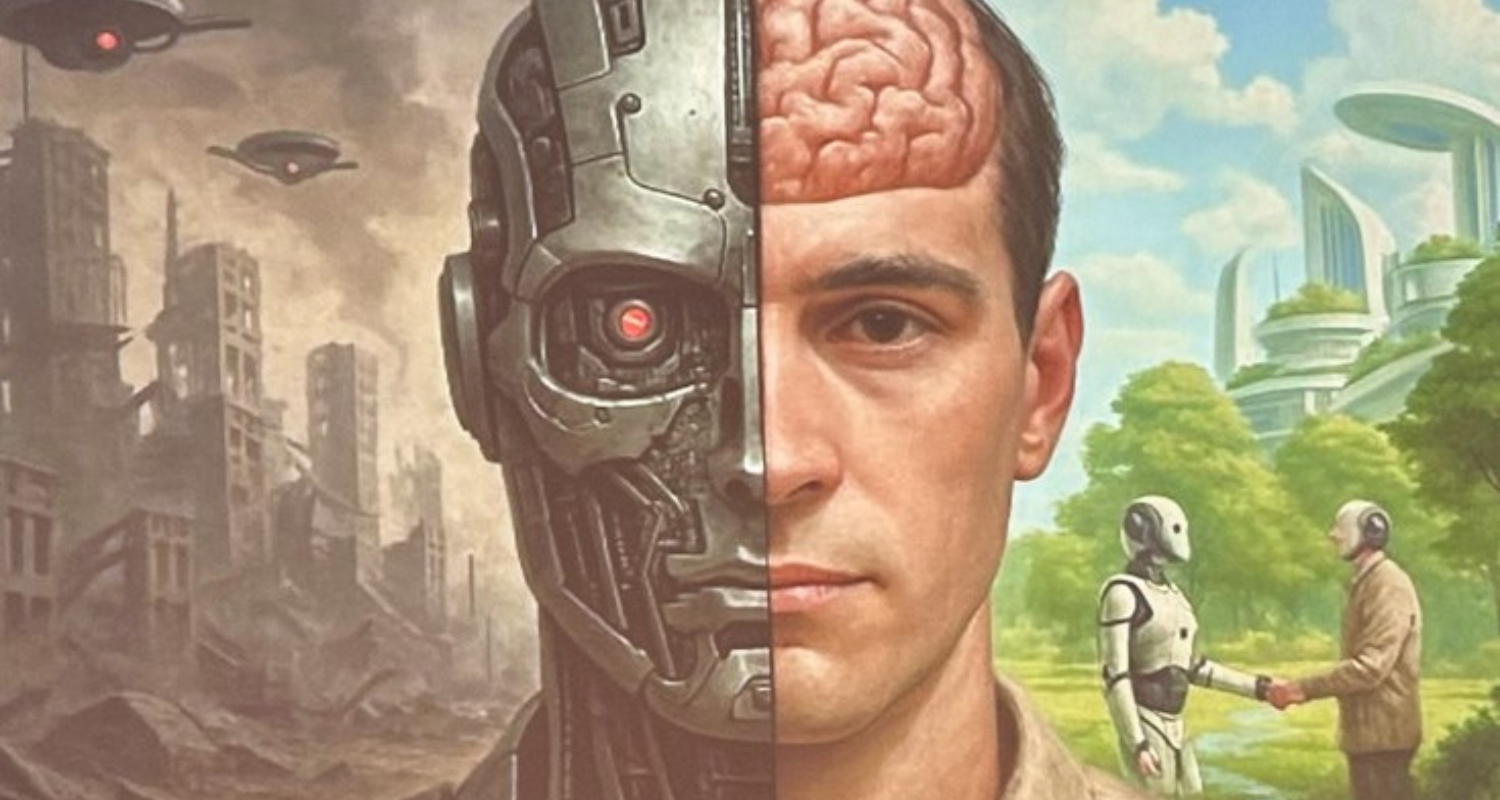

Our very first piece of thematic work (issued in March 2011) was called ‘the data deluge.’ In this, we posited a very simple thesis: the amount of data produced and consumed will grow exponentially, creating a range of investment opportunities. For if this data is to have any value, it needs to be stored, secured and analysed. Eight years on, our thesis remains as valid as ever, as the statistics bear out.

The combined (and mutually reinforcing) power of mobile broadband, cheap storage and network effects are driving the data deluge. In practical terms, over 188m emails are sent globally every 60 seconds. In addition, during this short period of time, 41m messages are sent via WhatsApp and/or Facebook Messenger, while a further 18m texts are transmitted via the more conventional SMS format. Beyond this, 3.8m search queries are logged every minute on Google, although this figure is dwarfed by the 4.5m video watched every minute via YouTube (owned by Google). Elsewhere, 1.4m swipes occur on Tinder and over 1m people are logging into Facebook in perhaps less time than it will take you to read this blog entry.

Who are the winners from all of this? At one level, users, since they are choosing to indulge in such activities (although whether such activity increases wellbeing is a different matter). Viewed from a different perspective, the platform companies which provide a plethora of these services could be considered clear beneficiaries. Once on a platform/ within an ecosystem, the opportunity cost of switching is significant. Even with the potential threat of increased regulation for such businesses, it seems likely that next year’s chart will show that the deluge is only deepening.

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook Street, Mayfair, London W1K 4HS

tel +44 20 7070 1800

email [email protected]

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.