Qblue Article 9 Fund remains AAA-rated on MSCI

We are pleased that our flagship sustainable UCITS Fund, the Qblue Global Sustainable Leaders Fund, remains AAA-rated by MSCI and ranks in the 100th percentile within the Global Equity peer group.

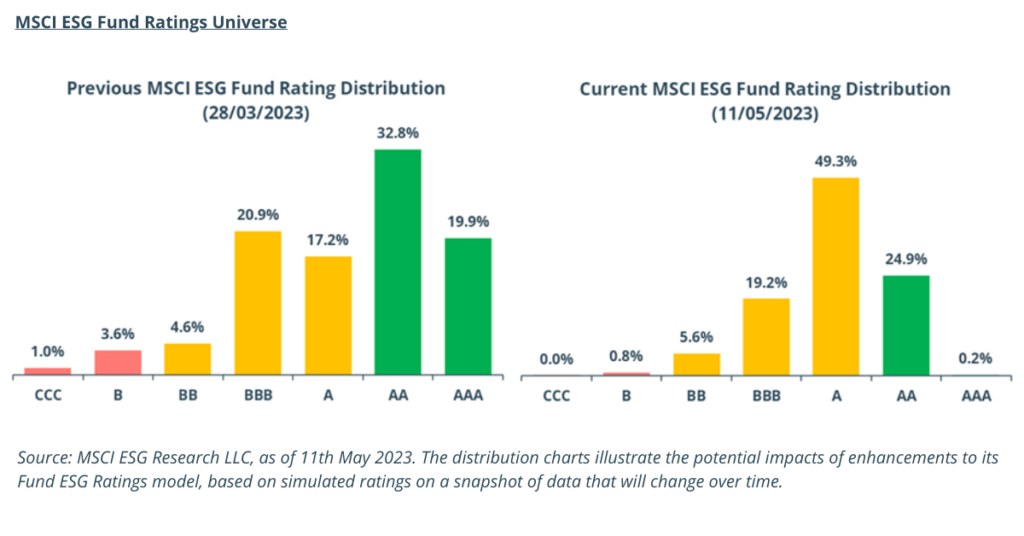

Recently, MSCI enhanced their ESG Fund Ratings to raise the requirements for a Fund to be assessed as a Leader (AA/AAA), improve stability in Fund ESG Ratings and add transparency through simpler attribution analysis. As a result, 31,000 funds (including their numerous share classes) saw a one-time downgrade in their ratings, and as seen below, only 0.2% of all funds now have a AAA rating compared to 19.9% before. Additionally, in a challenging year where regulatory pressure in Europe has led to fund managers downgrading the SFDR classification of almost €270bn in Article 9 funds, we are confident in Qblue’s sustainable credentials and the Fund’s current Article 9 SFDR classification. As such, Qblue is now one of the very few actively-managed SFDR Article 9 AAA-rated funds within the Global Equities peer group.

The Fund has raised almost $500m since launching in January 2022 and is sub-advised by Copenhagen-based Qblue Balanced, founded by Bjarne Graven Larsen, former CIO at ATP and Ontario Teachers’ Pension Plan. Watch our latest short video here, where Bjarne explains the Fund’s philosophy and process.

The Fund invests in companies that have come the furthest in the field of sustainability in every industry and region worldwide. Qblue’s in-house proprietary investment framework, The Sustainability Cube™, systematically builds a portfolio of companies located worldwide that have been identified as sustainability leaders in their respective fields. The Sustainability Cube™ framework defines and measures sustainability with a multitude of sub-measures to achieve a balanced and robust sustainability measure which allows the identification of sustainability leaders and laggards using the below three dimensions:

• ESG Industry Leadership Score • Climate Transition Score • UN SDG Score

For further information on the Fund, please click here.

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook Street, Mayfair, London W1K 4HS

tel +44 20 7070 1800

email [email protected]

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.