Robotics 2.0: the rise of the service robot

Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation.

Executive summary: Society needs service robots. They provide a clear solution to the twin global challenges of deteriorating demographics and growing healthcare burdens. A combination of mutually supporting technologies is helping to drive down the cost of robots and improve their efficiency. Against this background, the service robot market is set to expand by more than 5 times over the next 4 years and could be worth $36bn by 2020. Expect to see a growing service robot presence in hospitals, restaurants, border controls and homes too. We believe market leaders in niche segments (such as Intuitive Surgical) or key enablers in the technology stack look best-placed.

The robots are coming and their presence will soon be ubiquitous. We made this statement when we first wrote on the topic almost five years ago. Since then, we have seen increasing evidence to support this contention. However, as with many other future trends which we continue to analyse, robots are transitioning from being considered as machines for use in industrial manufacturing environments to enablers capable of providing a broad range of services. These can include the provision of labour, mobility, safety, convenience and entertainment. Crucially, the increasing emergence of service robots should help legitimise the overall concept of robotics and lead to an acceleration of industry growth prospects.

There are multiple (and sometimes conflicting) definitions of what constitutes a service robot. Best understood, they can be considered as robots that operate semi- or fully autonomously in order to perform services useful to the well-being of humans. Put another way, service robots are anything other than industrial robots. The overall robotics market was worth $42bn in 2015 (according to the International Federation of Robotics, a leading industry body), of which almost 85% comprised industrial robots, typically deployed in assembling cars or electronics. The remaining $7bn of the market was accounted for by service robots, split $4.4bn for professional services and $2.6bn for personal services. Professional service robots include military drones, medical robots, field robots (for agriculture) etc. and generally need to be operated by a highly-trained professional. By contrast, personal service robots can be used to assist elderly or handicapped people, perform household tasks or operate in commercial environments. Moreover, as robots gain in complexity, the uses to which they can be put are similarly expanding.

Both segments of the service robot market are set to experience strong growth over the coming years, with the IFR forecasting the professional service robotics market to expand by a factor of six and the personal service robots market to grow five times between now and the end of the decade. Taken together, the overall service robot market could be worth at least $36bn by 2020. If anything, we believe this estimate may be too conservative. Demographics and the ability to do more for less create a compelling logic for the expansion of the service robot market.

Begin with demographics. While there are currently around 840m people aged over 60 in the world, by 2050, this figure could reach 2bn, or over 25% of the world’s population, according to the World Health Organisation. Furthermore, the growth in working age populations for industrial countries has already slowed from 1% p.a. over the period 1970-1990, to 0.4% during the 1990-2010 horizon. Over the next 20 years. This rate of growth is forecast to turn negative, at -0.3% annually, based on data calculated by Citi. Against this background, there will be a structural imbalance between people needing some form of medical support and those able to provide it. In America alone, by 2020, 117m people are projected to need assistance, while the overall number of caregivers (both paid and unpaid) is expected to reach only 50m (figures courtesy of the consultancy BCG). In Japan, the government has stated that owing to a shrinking labour force as well as a greater demand for elder care, the country will be short some 380,000 nurses by 2025, although many experts put this figure at closer to 500,000. Robots provide one possible solution to the demographic dilemma.

Robots can also provide a means for doing more with less, in other words, increasing efficiency and reducing costs. This matters, especially since healthcare costs account for 10% of global GDP and 18% of US GDP, based on World Health Organisation data. The cost savings to a business from deploying robots could be as much as 15% annually within the next 10 years, according to calculations made by BCG. Even if this figure does require a degree of caution owing to the assumptions that underpin it, the case for robots stands up simply through making the assumptions that if some parts of jobs can be automated, then it will allow for professionals to perform more complex tasks; jobs are redefined rather than eliminated with the arrival of robots. Additionally, if the presence of robots does permit for the substitution of work-time for increased leisure, then this could also drive an increased quality of life.

The reason why such arguments have gained in potency is a function of a confluence of trends. More computational processing power, lower data storage costs, increasing interconnectedness and the expansion of smart materials are making robots more and more economically viable to deploy. As a result, the payback period for owning a robot is falling. An investment of $100,000 today buys, for example, a robotic system that can perform two times the work that a similarly priced machine would have cost a decade ago, according to BCG. Looking ahead, a combination of further hardware and software price declines as well as increasing efficiency should result in payback periods continuing to improve, thus accelerating adoption.

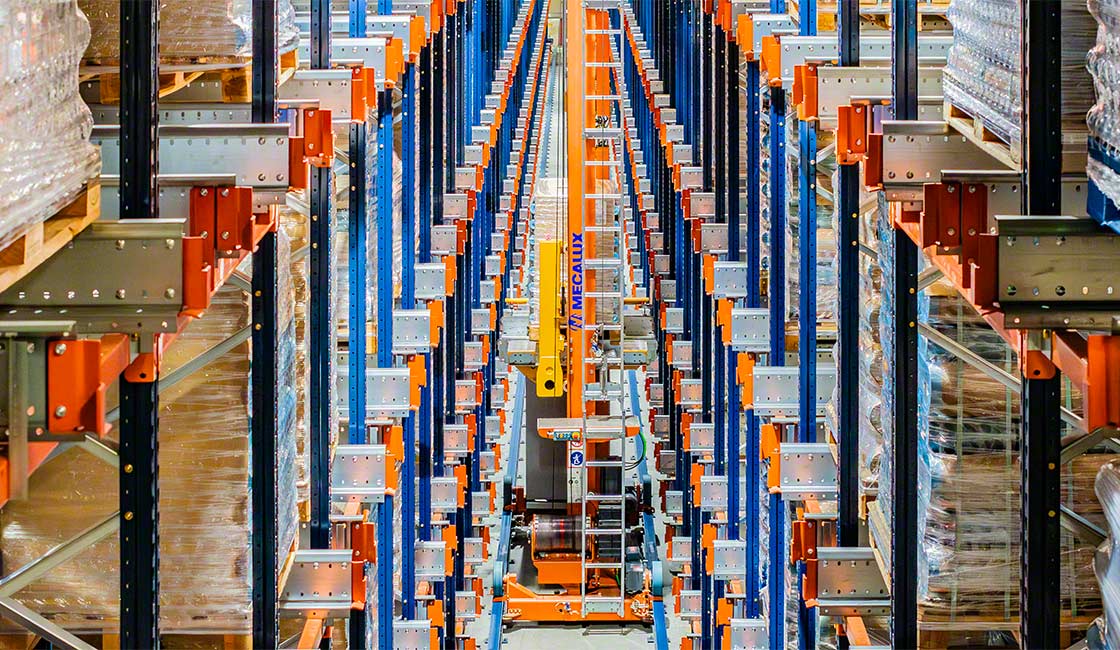

Most service robots are currently deployed within the fields of defence, logistics, agriculture (primarily for the mass milking of cows) and medicine (generally assisted surgery and therapy). Those present in the medical sector typically command the highest price – up to $2.5m per system – owing to their complexity. Amazon was one of the first businesses to embrace the concept of using robotics for its logistics operations. When it acquired Kiva in 2012, it had fewer than 1,000 robots in service globally. Now, this figure is estimated to be at least 30,000. Each Kiva robot can improve processing time relative to a human by around a factor of six. Within the medical segment, Intuitive Surgical stands out as the market leader, having installed over 3,900 of its robotic systems in hospitals at the end of 2016, an increase of over 400% since the start of the decade. 750,000 robotic procedures were carried out in 2016, yet with its robots installed in just 25% of all US hospitals and fewer than 10% of all global hospitals, the market opportunity ahead remains significant.

While the scope for the expansion of the professional service robot market is clear, there are also attractive growth prospects ahead for personal robots. These typically retail in the $500-5,000 category at present, but prices are set to fall as a function of the factors described previously. Indeed, the IFR forecasts 42m service robots for personal and domestic uses to be sold between now and the end of the decade. Robotic vacuum cleaners, floor scrubbers and pool cleaners among others have now been available for over 15 years, but the current generation of service robots emerging are a marked step-up in terms of sophistication and hence capabilities. The author of your piece has had the opportunity to meet with and engage with several of these robots at industry trade fairs in both the US and Europe over the last year. ‘Pepper’ is perhaps the best example. Launched in June 2015 by a subsidiary of Softbank, it is marketed as “the first robot designed to live with humans.” The robot is 4-foot tall, has 20 separate engines for motion control and 12-hours of battery life. Anecdotally, some 1,000 Pepper units a month are being sold at present, with an average retail price of approximately $1,500.

Elsewhere, Momentum Machines (a private company based in San Francisco) has developed a robot that can autonomously produce 400 burgers an hour and perform every task from cooking the meat to assembling the burgers. The first ‘robot-only’ restaurant with a human-free kitchen was launched in San Francisco last summer, with Momentum’s robots each doing the work of three humans. In China, robots have not only been deployed in cafes, but also at border control points. At the border between Zhuhai and Macau, where 1.2bn people pass annually, robots can speak in 20 different languages to those crossing and perform their tasks using facial recognition technology. Japan also has plans to deploy robots in a variety of capacities (from taxi-driving to information provision) at the 2020 Olympics.

Countless other examples support the idea that the robots are coming. However, not all are convinced. Concerns centre on privacy, safety and liability issues. Rather than robots going out of control, a more pertinent worry perhaps relates to the risk of hacking. This will matter, particularly as the number of connected devices grow. Societal acceptance is another topic of importance. In a recent survey conducted in Japan by Mitsubishi UFJ Research, respondents were happy to have robots clean their hotel rooms (where they would generally not be visible to guests), but still stated by a clear majority they valued bona fide human interaction at the reception desk. There are still no clear answers over the extent of job losses that increasing robotization may bring. Some (including Bill Gates) have even suggested that robots – or their owners – should be taxed. All these issues and more will need to be addressed as the industry grows.

There will be clear beneficiaries from the growth of the service robot industry, but it is important to be aware that the boundaries are blurred and overlapping. In other words, not only are there limited pure-play businesses, but also that many of the underlying technologies upon which robots rely are also deployed in other fields too. Additionally, there is relatively sparse data on market shares, with many companies reluctant to disclose detailed information on robots sold. Our preference is to gain exposure via market leaders in niche fields and/or to invest in integral parts of the technology stack.

Within the industrial robot segment, FANUC stands out as the market leader, and is estimated to have a global market share of over 20%. The collaborative robot (or ‘cobot’) market, where robots work alongside humans in various industrial capacities is currently led by ABB, Rethink Robotics and Teradyne, although the first of these businesses still derives most of its revenues from power grids and electrification products, while Rethink remains private. Moving into the professional medical service robotics segment, and Intuitive Surgical dominates. Meanwhile, within the field of logistics, Amazon seems to be ahead of its peers. German-listed Jungheinrich and KION provide logistics systems and look well-positioned. Across the technology stack, our preference is for software plays over hardware businesses, since the former is less commoditised. Alphabet (Google), Amazon, Baidu and IBM are all currently active in developing the ‘brains’ (or artificial intelligence) that will be critical for the successful evolution of robots.

Alexander Gunz, Fund Manager, Heptagon Capital

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook Street, Mayfair, London W1K 4HS

tel +44 20 7070 1800

email [email protected]

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.