Season 6, Post 15: AI and Its Discontents*

What a difference a year can make. Wind the clock back. At the start of 2023 and almost every Board was pressuring its CEO to find ways to adopt generative AI as quickly as possible. Listen to corporate earnings calls and the term is still being bandied around by executives with regularity. 179 S&P 500 Index companies talked about the technology in the recent Q4 reporting season, down just slightly from the peak of 181 recorded in Q2 2023. On the ground, however, the reality is very different.

Businesses may talk about the transformational benefits of AI, but the extent to which they are using it seems very different. Generative AI models still have an unfortunate ability to hallucinate. Trust is therefore needed that tools don’t simply make things up. Data also need to be trained with significant guardrails in place. Only 5% of American firms of all sizes say they are using AI at present, while merely a further 7% say they plan on adopting it within six months, per the US Census Bureau.

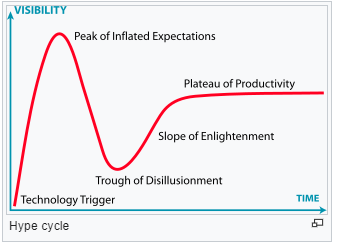

Every major technology goes through a cycle. Might we be at the peak of inflated expectations for AI? If history is any guide, then a trough of disillusionment may follow. Some leading AI start-ups have already fallen by the wayside. Inflection AI’s leadership has moved to Microsoft. Stability AI has seen its CEO and co-founder resign. When Boston Consulting Group recently asked executives about prospects for AI, a majority said it would take at least two years to move beyond the hype.

Of course, it’s important to look beyond. After the trough comes a slope of enlightenment. Falling computing costs and more training will make generative AI solutions better. After an infrastructure layer – what NVIDIA is effectively selling today – a more practical application layer should follow.

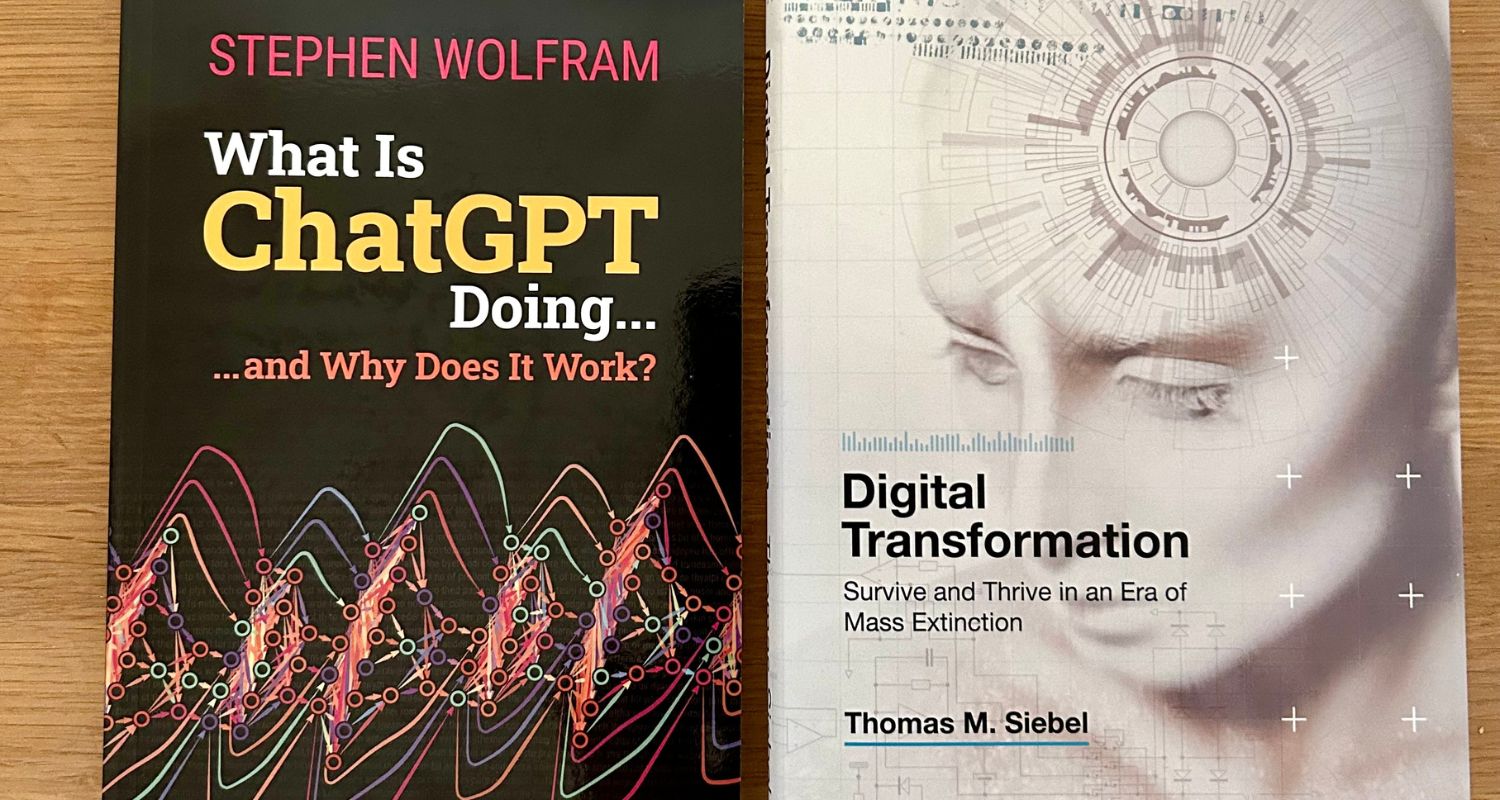

Two recent books we read also provide a useful reminder of how we should consider the technology. What is Chat-GPT Doing by Stephen Wolfram demonstrates to readers just how complicated it is to create a neural data network analogous to a human brain. There is no overnight quick fix. Meanwhile, Digital Transformation by Thomas Siebel makes the valid point that AI should be thought of as part of an entirely new technology stock. Only when combined with elastic cloud computing, big data and an Internet of Things can AI reach its full potential.

*With apologies to Sigmund Freud. His famous work, Civilisation and Its Discontents explores the clash between the desire for individuality and the expectations of society.

9 April 2024

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Click here to view all Blog posts.

Alex Gunz, Fund Manager

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook Street, Mayfair, London W1K 4HS

tel +44 20 7070 1800

email [email protected]

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.