Season 7, Post 22: The third pillar

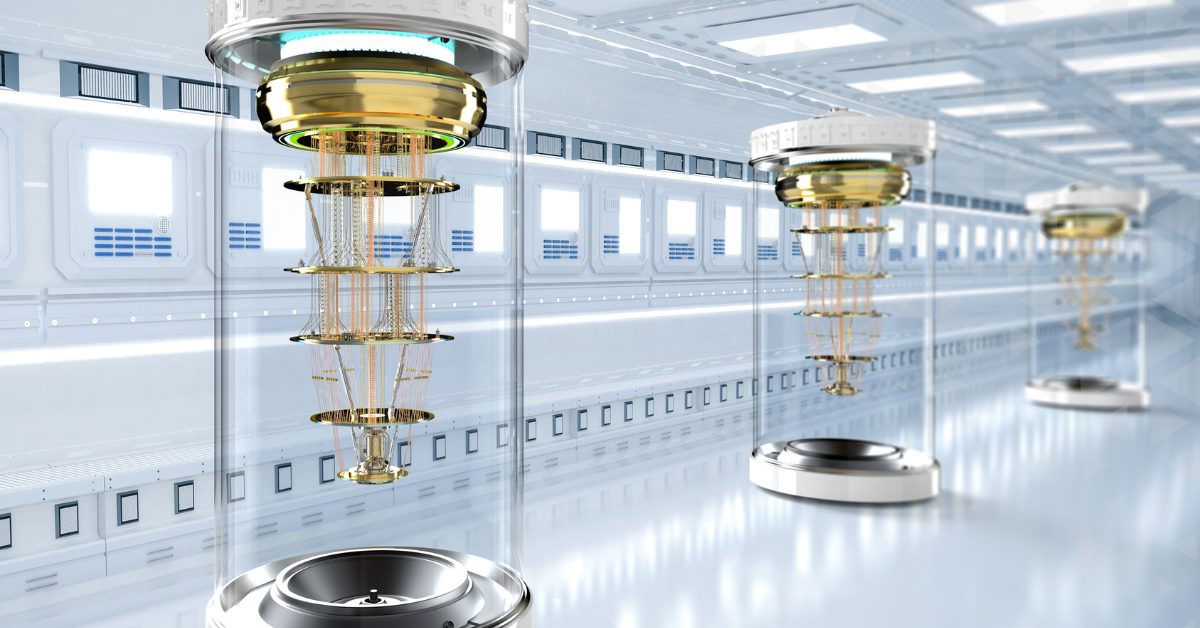

2025 is, in case you were not aware, the UN International Year of Quantum Science and Technology. And rightly so. If artificial intelligence was not a big enough technological tsunami, then prepare yourself for quantum computing. The potential of quantum is far from novel. We have written on the topic since 2017 and more recently in 2023 but already this year we have seen several major breakthroughs. The transformation may arrive sooner than expected.

Think of quantum as a replacement neither for conventional computing nor generative AI. Rather, it should be seen as a complement, or as the “third pillar” of modern, high-performance computing. This metaphor was used by an industry expert (formerly employed at Google and Amazon) with whom we recently spoke on the topic. He highlighted that while recent advances in AI had been revolutionary, current digital computing is still very bad at solving many problems. AI does not “understand” complex natural systems such as biology or chemistry, where the range of possible outcomes to any problem is an order of magnitude that is hard for humans to comprehend (ask if you want to know the details).

The good news is that there have been several recent breakthroughs in the quantum space that have helped to turbo-charge progress. Microsoft announced in February its Majorana 1 quantum chip. A month later, start-up D-Wave claimed it had achieved ‘quantum supremacy’, or the state where a quantum computer surpasses the capabilities of the most powerful classic digital computer. In May, the latest news came from Cisco and their unveiling of an entanglement chip, which it says could accelerate practical quantum computing by a decade.

When technological progress translates to commercial value, however, remains more open to debate. Our expert contact highlighted a range of quantum potential use cases, all centred around optimisation. These could include container storage planning for shipping companies, simulations for materials characteristics, predicting the toxicity of molecular reactions and scheduling charge for electric vehicles. If quantum follows the AI playbook, then the infrastructure providers look best placed to benefit initially. D-Wave’s share price has gained more than 90% year-to-date, even if Bloomberg consensus estimates show it will be loss-making for the foreseeable future.

17 June 2025

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Click to here view all Blog posts.

Alex Gunz, Fund Manager

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook

Street, Mayfair, London W1K 4HS

tel +44 20 7070

1800

email london@heptagon-capital.com

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.

Receive the updates

Sign up to our monthly email newsletter for the latest fund updates, webcasts and insights.

.png)

.jpg)