Season 7, Post 25: Which pill would you choose?

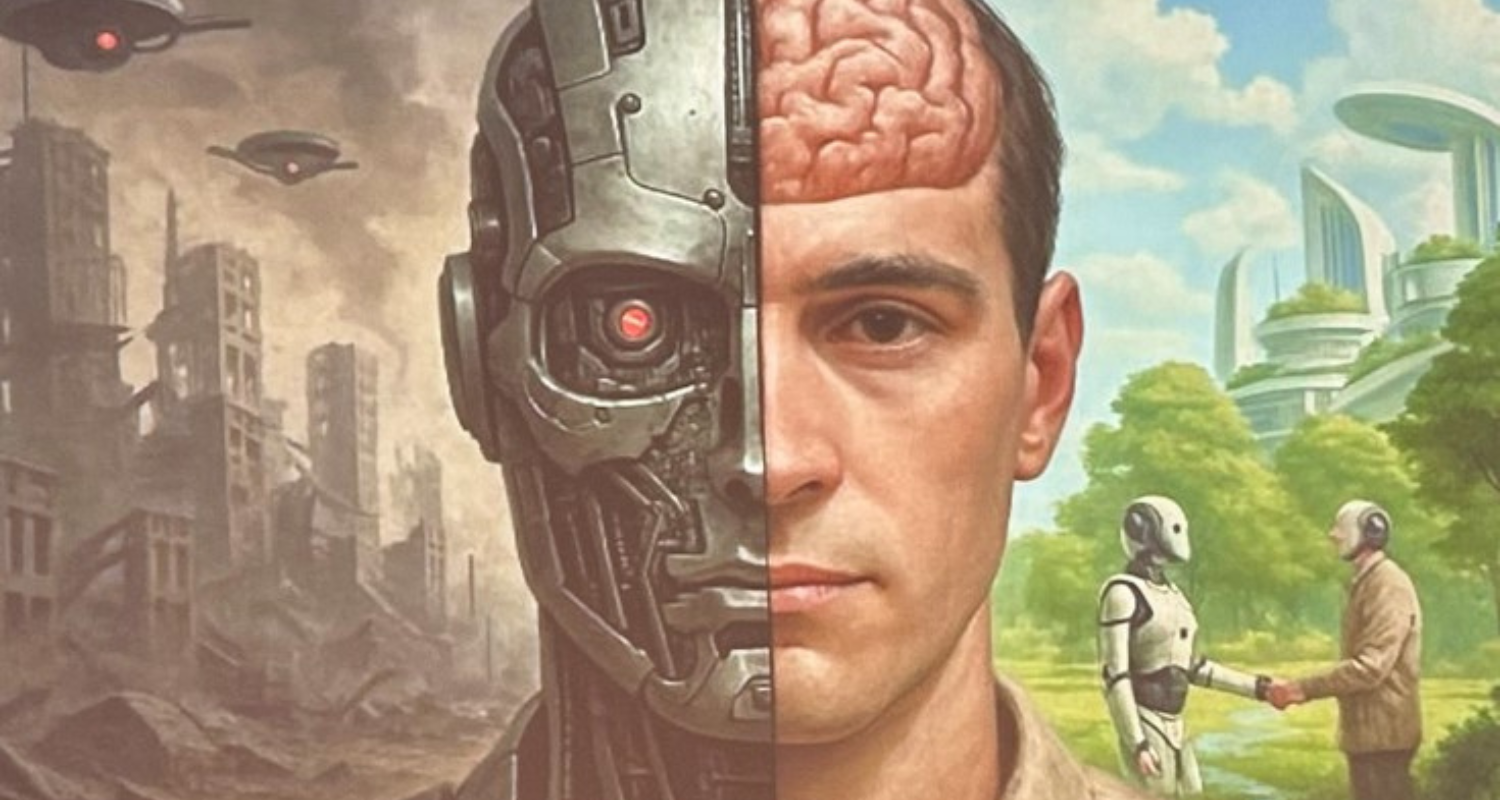

Would you rather “believe whatever you want to believe” or prefer to see “how deep the rabbit hole goes?” Life, fortunately, is not quite as binary as the choices laid out in the iconic film The Matrix. However, the red pill/ blue pill metaphor continues to resonate. When applied to the AI debate it could be framed as whether the technology might result in a digital utopia or, less happily, an algorithmic apocalypse. This dialectic was the centre of a fascinating series of lectures your author attended at The Royal Institution earlier this week.

In the metaphorical blue corner Kay Firth-Butterfield, an eminent lawyer and professor, highlighted how AI in its current form is “not sustainable.” Her concern related not just to the environmental impact – each LLM request apparently uses a quarter of a litre of water in data centre cooling, while the industry already emits more greenhouse gas than the airline sector – but to how AI is “creating stupidity.” She asserted that humans are increasingly being asked to trust in algorithms without questioning the quality of the data and inherent biases built in. Before the technology gets out of control, better regulation is required.

A much more optimistic counter argument was laid out by Dr Pippa Malmgren, an American economist and technologist. Her view – and one to which this author is sympathetic – is that AI can act as an accelerator for innovation. The technology can provide us with new ways of looking at the world and solving previously intractable problems (including energy shortages and pollution). AI has the potential to “expand the reach of all humans.” In such a world view, economics becomes less about managing scarcity and more about harnessing abundance.

What might be an ideal path for AI to take? No-one knows. One plausible way forward might be for the technology to seek to replicate the human brain as closely as possible. Such a view was outlined by the event’s third speaker – Nikolay Gurianov, the founder of Braintree, a tech start-up. Human brains, we learned, are not only highly energy efficient, but they are always optimising, creating and adapting learnings from multiple (and often symbol-driven) inputs. While Braintree is still evolving its technology, the concept is an alluring one.

From our perspective, it is only natural for humans to be resistant to change. But consider how what was once commonplace – the horse and cart, for example – is now obsolescent. Charles Darwin arguably puts it better than anyone in noting that evolution comes from adapting to reality. Now that the AI age is upon us, there is no turning back.

9 July 2025

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Click to here view all Blog posts.

Alex Gunz, Fund Manager

Photo by the author

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook

Street, Mayfair, London W1K 4HS

tel +44 20 7070

1800

email london@heptagon-capital.com

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.

Receive the updates

Sign up to our monthly email newsletter for the latest fund updates, webcasts and insights.

.jpg)