Season 6, Post 12: California Dreaming: Notes from the Valley

Anyone vaguely familiar with how the Large Language Models that drive products such as Chat-GPT work will know that they have a tendency to hallucinate. After having spent most of last week in California, your author sometimes wondered if he were hallucinating. Jetlag notwithstanding, the fervor around all things AI verged almost on the hyperbolic.

Land at San Francisco airport and drive to the city. Almost every billboard along the way will tell you how AI can ‘10x’ or ‘turbo-charge’ your business. Sit in a bar and sip beer. Listen to the conversation around you and nearly everyone is talking about how they’re working on an AI project. If not, then their friend is. At times, it almost felt like 1999 and the moment when the Internet went mainstream.

Nobody said “this time it’s different” in as many words to your author, but several came close. During his time, your author met with 13 companies ranging from over $500bn in size to a Series-B funded start-up. At 5 of these businesses, he met with C-level management. He was told by one senior executive that AI is “profoundly different.” Another said “levels of interest are unbelievable… as barriers to resistance melt.” AI, he was reassured by a third business leader “will make us quicker.”

Fancy words for sure. If anyone is going to fashion the tools that will enable AI to become mainstream, then it will be those in the Valley. San Francisco might have one of the most appalling homelessness problems among major US cities, but it attracts over 40% of the country’s VC funding, more than three times the level of the next closest state (New York).

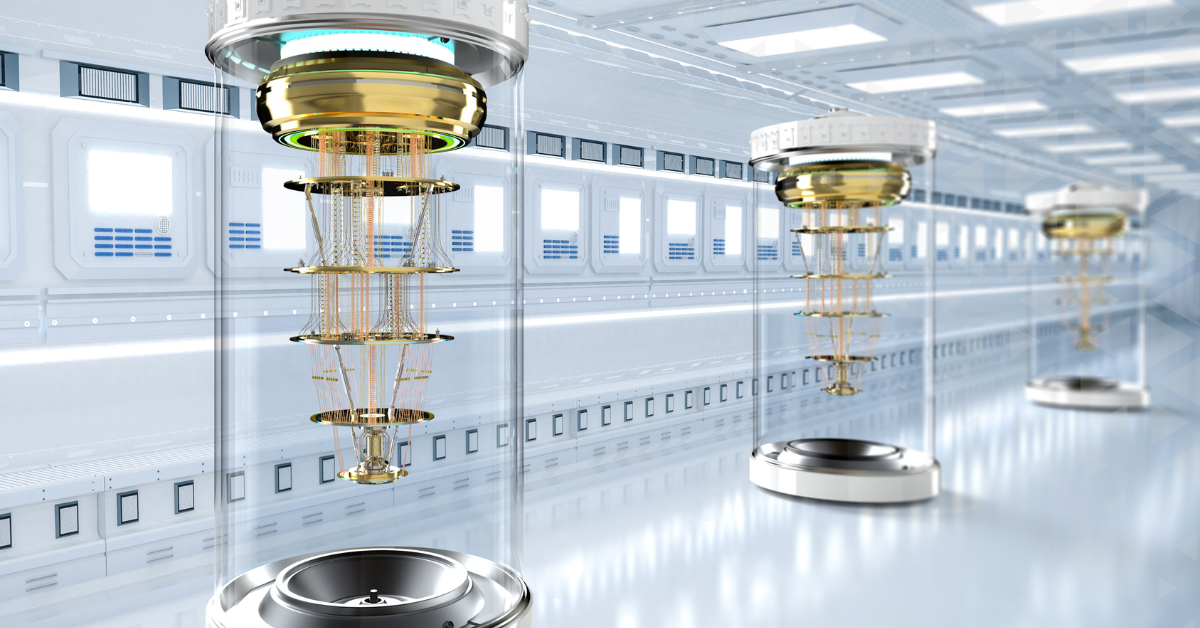

Why are we still in an early innings with AI? Your author was reminded that pre-trained models can already pass Bar exams. An average law student would need 400 hours to achieve a similar feat. By contrast, a teenager could learn to drive in a tenth of this time, but no autonomous car can come close. Indeed, your author heard how almost all the self-driving cars that had previously operated on a trial basis in California had been retired owing to safety concerns. If driving successfully is about prediction, contextual learning, vision and more, LLMs lack full functionality today. This implies the need for more training of models and further inferencing. It also means more GPUs and more silicon.

Believe such a world view and “no way is this a hype a cycle”, as one Chief Executive put it to us. NVIDIA is, we were told, training models “to do things never done before.” No surprise then that AI is now part of every business (and investor) conversation. Few, of course, were willing to share their views on valuation, although one highly experienced person with whom we spoke noted that “the market temporarily overvalues things it does not understand.” We will not opine here on this topic. It was, however, reassuring to witness innovation at work on this trip in areas other than just AI. Your author was particularly impressed with progress being made in robotic-assisted surgery and lab-grown food but will save these topics for another day.

19 March 2024

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Click here to view all Blog posts.

Alex Gunz, Fund Manager

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook Street, Mayfair, London W1K 4HS

tel +44 20 7070 1800

email [email protected]

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.